ABSOLUTE DIRECTIVE: TITLE FULFILLMENT

Alright, let's dive into this Solana situation and see if it's actually a "comeback" story or just another dip.

DeFi's October Jolt: Solana's Position

The DeFi sector is still feeling the aftershocks from that October crash. DeFi Token Performance & Investor Trends Post-October Crash paints a pretty clear picture: most DeFi tokens are still underwater. Only 2 out of 23 leading DeFi names are positive year-to-date as of November 2025. The group is down 37% on average for the quarter. But, as always, the averages hide some interesting divergences.

Investor Trends and Market Dynamics

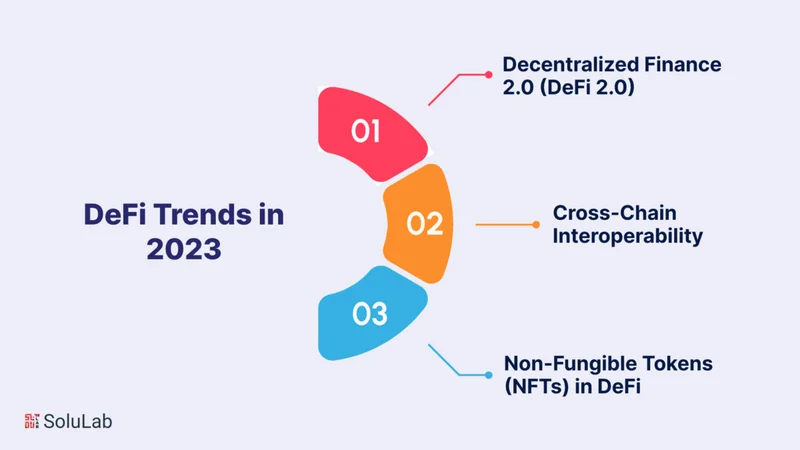

Investors seem to be rotating toward safer bets, like tokens with buyback programs (HYPE, CAKE) or those with unique catalysts (MORPHO, SYRUP). It's a flight to quality, or at least, perceived quality, in a shaky market. Lending and yield names are also seeing some relative strength, possibly because investors see them as less risky than pure trading plays.

DEX Performance and Underlying Activity

The interesting thing is that some DEXes (CRV, RUNE, CAKE) are posting greater 30-day fees as of November 20 compared to September 30, even as prices have taken a hit. This suggests that while the market cap is down, the underlying activity is still there. People are still using these platforms; they're just less willing to pay a premium for the tokens right now.

Solana's Discount and Core Technology

And Solana? Well, it's trading at a "55% discount" from its all-time high, according to one source. The question is, is that a bargain or a warning sign?

Solana's consistently high throughput (1,000+ TPS) and low transaction costs (around $0.00025 per transaction) are definitely selling points. The network’s combination of Proof of History (PoH) and Proof of Stake (PoS) is central to its high-speed transaction capabilities. PoH functions as a cryptographic timestamping system, allowing validators to process transactions more efficiently by providing a verifiable historical record. PoS secures consensus through token staking, incentivizing network participants to maintain reliability. It's built for speed and scale, which is crucial for DeFi applications.

Validator Concentration and Market Correlation

But there's a catch: high throughput comes with high hardware demands. This raises the barrier to entry for validators, leading to some concentration. The Nakamoto Coefficient of 20 indicates moderate decentralization, comparable to other top Layer-1 blockchains. Is that good enough? It depends on your risk tolerance.

The other issue is that Solana's price is still heavily influenced by Bitcoin and Ethereum trends. The correlation coefficients are 0.72 and 0.68, respectively. That means even if Solana has great fundamentals, it can still get dragged down by the broader market.

Is This Time Different? Maybe.

Okay, here's where I get a little more subjective. I've looked at hundreds of these "next big thing" blockchain analyses, and Solana has always been a bit of a puzzle. It should be dominating the DeFi space, given its technical advantages. But it hasn't, at least not consistently.

Solana's TVL and Adoption Rate

The DeFi TVL on Solana is $5.1B. NFTs add another $1.2B. That's not nothing, but it's also not Ethereum levels (which is at $50B). The key, as always, is adoption.

"Next Crypto to Explode" Lists and Market Hype

The 99Bitcoins article lists Solana as one of the "15 Next Cryptocurrencies to Explode in 2025," citing its growth potential in the smart contract market and the 55% discount. They also point to Jupiter (JUP), a Solana-based DEX, as another potential winner.

But let's be real: a lot of those "next crypto to explode" lists are just marketing hype. They’re based on the idea that more buyers than sellers will cause prices to move higher. But, as Eric Peters pointed out, sometimes prices fall even when most investors think they should rise.

Solana's Valuation: Undervalued or Correctly Priced?

So, what's the real story with Solana? Is it undervalued, or is the market correctly pricing in the risks and limitations?

Token Distribution and Staking Rewards

The Solana Foundation/Ecosystem gets 12.92% of the token distribution. This is meant to fund ongoing development and incentives for adoption. Meanwhile, Early Investors get 10.46% of the token distribution. Private allocations may influence short-term liquidity. And this is the part of the report that I find genuinely puzzling...

The tokenomics are also worth considering. About 60% of the SOL supply is allocated to the Community/Staking Rewards. The staking yield is around 6-7% annually, incentivizing long-term holding and reinforcing network security. That's a decent incentive, but it also means a lot of SOL is locked up, reducing liquidity.

Interoperability and Cross-Chain Flows

Solana’s interoperability with other blockchains has become an important factor in its adoption. Understanding how to transfer BNB (BSC) to SOL is increasingly relevant, as it allows tokens to be used for staking, DeFi participation, and NFT activity without converting to fiat. These cross-chain flows support liquidity and broader ecosystem engagement.

Solana's Strengths and Weaknesses: A Summary

So, let's put it all together. Solana has:

* A technically superior blockchain (at least on paper). * A growing DeFi and NFT ecosystem. * A discounted price (relative to its all-time high). * Some validator concentration risks. * Heavy reliance on broader market trends.

The question isn't whether Solana can make a comeback. It's whether it can overcome its challenges and achieve its full potential.

This is Still a Speculative Bet

Solana is a risky bet. But it's a calculated risky bet. The underlying technology is solid, and the ecosystem is growing. If you're willing to stomach the volatility and do your own research, it could be worth a look.